Hyperliquid in 2026: How DEX Perpetuals Work Without KYC and What Risks Traders Face

Hyperliquid has become one of the most discussed decentralised perpetual futures venues because it combines high-speed execution with an on-chain settlement model and does not require traditional identity checks. By 2026, this type of DEX-perps trading is no longer a niche experiment: it is a serious alternative for traders who want direct custody, fast order matching, and access to derivatives without relying on centralised intermediaries. At the same time, the absence of KYC and the complexity of smart contract infrastructure introduce risks that every participant must understand before trading.

Liquidity Model, Order Execution, and the Reality of Thin Markets

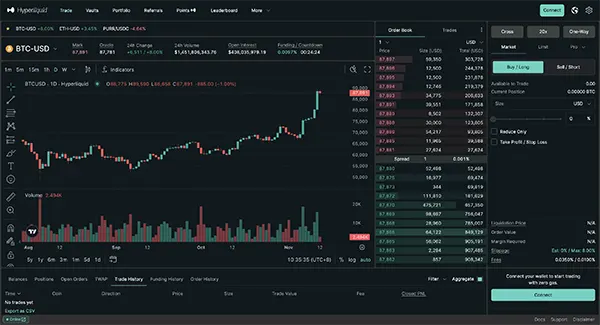

Hyperliquid’s liquidity model is built around a central limit order book rather than a simple automated market maker. This matters because perpetual futures traders often need precise entries and exits, especially when trading with leverage. A limit order book allows market participants to see depth, place bids and asks, and interact with liquidity similarly to traditional derivatives exchanges, but with settlement anchored in decentralised infrastructure.

Order execution on DEX-perps depends heavily on how much liquidity is available at each price level. In highly liquid markets, trades can be filled with minimal price impact. In thinner markets, however, even moderate-sized orders can move through multiple levels of the book. This creates slippage, where the final execution price differs from what the trader initially expected, especially during volatile periods.

By 2026, traders have learned that “thin markets” are not just a minor inconvenience but a structural risk. Liquidity can disappear quickly when volatility spikes, leading to rapid widening of spreads and unpredictable fills. Hyperliquid users must pay close attention to depth, avoid aggressive market orders in low-volume pairs, and understand that decentralised order books can be more fragile than their centralised equivalents.

Slippage, Funding Dynamics, and Price Sensitivity in Perpetuals

Slippage is often underestimated by new derivatives traders, but in perpetuals it can compound losses because positions are leveraged. A small difference in entry price may not matter in spot trading, yet in a 10x leveraged perpetual, it directly affects liquidation thresholds. Hyperliquid traders in 2026 typically manage this by using limit orders, splitting large trades into smaller executions, and avoiding illiquid conditions.

Funding rates also shape execution outcomes. Perpetual contracts rely on funding payments to keep prices aligned with the underlying spot market. When funding is strongly positive or negative, traders may rush to open or close positions, temporarily distorting liquidity. Hyperliquid’s funding environment can therefore influence short-term order book imbalance, making timing an important factor.

Price sensitivity becomes particularly relevant in decentralised venues because liquidity providers are not guaranteed to stay. Unlike centralised exchanges that often maintain market-making programmes, decentralised systems depend on incentives and voluntary participation. This means liquidity conditions can change rapidly, and traders must treat execution risk as part of their overall strategy.

Smart Contract Risks and Operational Vulnerabilities

Trading perpetuals on Hyperliquid means interacting with smart contracts that manage margin, settlement, and liquidation logic. While audits and security practices have improved by 2026, smart contract risk can never be fully removed. Bugs, economic exploits, or unforeseen edge cases remain possible, particularly in complex derivatives protocols.

Another layer of risk comes from cross-chain infrastructure and bridging. Many traders move collateral between networks, which introduces exposure to bridge failures or exploits. The crypto industry has seen repeated bridge incidents over the years, and even in 2026, bridges remain one of the most vulnerable points in decentralised finance. A trader may execute perfectly but still face losses if assets become stuck or compromised during transfer.

User error is also a major operational risk. Managing private keys, signing transactions, choosing the correct network, and understanding liquidation parameters all require discipline. Unlike centralised exchanges, there is usually no customer support that can reverse mistakes. On Hyperliquid, responsibility sits almost entirely with the trader.

Liquidations, Network Stress, and the Human Factor

Liquidation mechanisms are critical in perpetual futures trading, and decentralised systems must handle them transparently. In fast market moves, liquidations can cascade, pushing prices further and creating feedback loops. Traders in 2026 recognise that liquidation risk is not just about leverage but also about market microstructure and liquidity depth.

Network stress can also affect trading outcomes. If blockchain congestion increases transaction confirmation times, traders may struggle to adjust positions quickly. Even if Hyperliquid’s matching layer is designed for speed, settlement and withdrawals still rely on underlying network conditions. This creates an operational gap compared with fully centralised systems.

The human factor remains one of the biggest vulnerabilities. Overconfidence with leverage, misunderstanding funding costs, or failing to set risk limits often causes more damage than technical exploits. Hyperliquid provides powerful tools, but it demands professional-level risk management from its users.

Who Hyperliquid Fits Best: Scalping, Hedging, and Position Trading

Hyperliquid is particularly attractive to scalpers because of its order book execution model and the ability to trade perpetuals without handing custody to an exchange. Scalpers benefit from tight spreads in major markets, but they must also account for slippage in volatile moments. For short-term strategies, execution quality matters more than almost anything else.

For hedgers, decentralised perpetuals offer a way to offset exposure without relying on centralised venues. Traders holding spot assets can hedge downside risk through short perpetual positions. This can be useful for long-term investors who want protection during uncertain market conditions while keeping custody of their underlying holdings.

Position traders may also find Hyperliquid suitable, especially if they want access to derivatives without KYC constraints. However, longer-term positions require careful monitoring of funding payments, margin health, and protocol-level risks. Holding a leveraged position for weeks is fundamentally different from intraday trading.

Practical Risk Awareness for Different Trader Profiles

Scalpers should prioritise liquidity depth, avoid low-volume pairs, and treat transaction costs and slippage as key variables. Hyperliquid can offer speed, but only disciplined execution prevents small inefficiencies from eroding profits.

Hedgers need to understand that perpetuals are not perfect substitutes for spot holdings. Funding costs, liquidation thresholds, and market dislocations can make hedges imperfect. The best hedging approach is usually conservative leverage with clear collateral management.

Position traders must balance the benefits of decentralised access with protocol and operational risks. In 2026, the most successful Hyperliquid users are those who combine technical understanding with strict risk controls, rather than those chasing leverage without preparation.